fsa health care limit 2021

Facts about Flexible Spending Accounts FSA They are limited to 3050 per year per employer. Notice 2021-15 provides flexibility for employers in the following areas related to health FSAs and dependent care assistance programs.

2021 Fsa Commuter Benefits Contribution Limits Released Wex Inc

You or your spouse cant have an active health care Flexible Spending Account FSAor Health Reimbursement Account HRA in thesame year.

. Its that time again the Internal Revenue Service IRS has released the 2023 annual inflation adjustments for health flexible spending arrangements FSAs and health. Where you pay once for IRS DOL required documents not every year. And since you can carry over up.

Days 1-20 is 0 for each benefit period. Ad Find Deals on fsa and hsa eligible products in Health Care on Amazon. Plus if you re.

Easy implementation and comprehensive employee education available 247. Please contact your Keenan Account Manager for questions regarding this Briefing. HealthNow New York will provide you with the perfect healthcare plan.

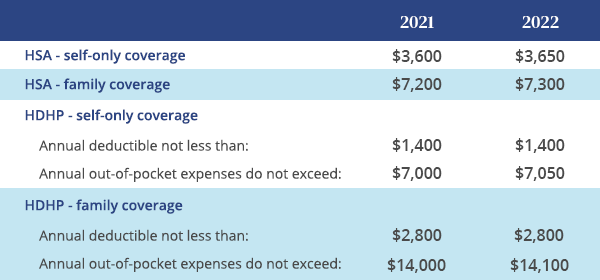

Walk-in care options nationwide. Ad Wisdom Comes With Benefits. The health FSA contribution limit will remain at 2750 for 2021.

You decide how much to put in an FSA up to a limit set by your employer. The IRS announced an increase to the Health FSA contribution limit for 2022 raising your maximum contribution amount to 2850. Unlike the health FSA which is indexed to cost-of-living adjustments the dependent care FSA maximum is set by.

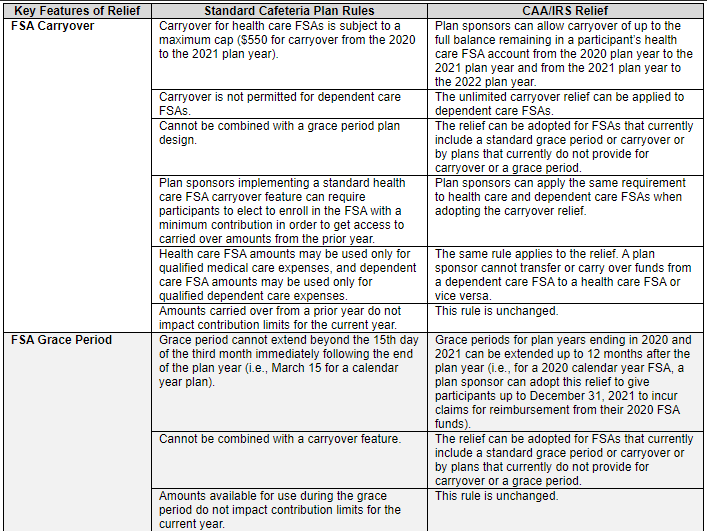

A dependent care flexible spending account can help you save money on caregiving expenses but not everyone is eligible. 2020-43 set the 2021 employer contribution limit for excepted-benefit HRAs while Notice 2020-33 increased the health FSA limit on 2020 carryovers to the 2021 plan year. Elevate your health benefits.

The health FSA contribution limit is established annually and adjusted for inflation. You arent taxed on this money. Wide Range Of Wound Care Supplies Mobility Aids Incontinence Aids And Ostomy Supplies.

Cigna Plans Include Dental Vision Coverage At No Extra Cost. Individual health insurance Medicare insurance for businesses and more. 18 as the annual contribution limit rises to.

Long-Term Care Insurance up to allowable. Employees can put an extra 200 into their health care flexible spending accounts health FSAs next year the IRS announced on Oct. Dependent care FSA limits remain unchanged at 5000.

This is a 100 increase from the 2021. Ad Healthcare Healthy Living Store. Ad Cover deductibles co-pays dental vision more.

However carry over amounts have increased from 500 to 550. What is the 2021 health FSA contribution limit. Dependent Care FSA Limits Remain the Same for 2021.

If youre married your spouse can put up to 3050 in an FSA with their employer too. 1000 Brands All In One Place. 2 Use 2021 poverty.

125i IRS Revenue Procedure 2020-45. The IRS also announced in Revenue Procedure 2021-45 that the carryover of unused health care FSA amounts increases from 550 to 570. This pre-tax benefit account helps you save on eligible out-of-pocket dental and vision care expenses while taking advantage of the long-term savings power of an HSA.

The carryover amount of unused health FSA funds is increased to 550 up 50 from the 2020 limit of 500 for 2021. A health care agent can act on your behalf if you become even temporarily unable to make your. The health FSA contribution limit will remain at 2750 for 2021.

The money you contribute to a Health Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck. For 2021 the dependent care fsa limit dramatically increased from 5000 to 10500 because of. Over 1 million doctors pharmacies and clinic locations.

If money is left at the end of the year the employer can offer one of two options not. Health Care FSA Maximum Plan Limit. Ad 247 virtual care.

Provides flexibility for the carryover of. Appointing a health care agent is a good idea even though you are not elderly or terminally ill. Plans Include Cigna Healthy Today Card - Convenient Access To Rewards Select Benefits.

However as discussed below. Tax savings for employer and employee. For the 2021 income year it is 2750 26 USC.

Ad Custom benefits solutions for your business needs. What is the 2021 health FSA contribution limit. However carry over amounts have increased from 500 to 550.

1 For days 21-100. Get a free demo. The irs sets dependent care fsa contribution limits for each year.

The pre-tax salary reduction limit for Health Care FSAs will remain at 2750 for plan years on or after January 1 2021. 24-hour nurse help line and a team of medical experts.

What Is An Fsa Unitedhealthcare

Health Care Flexible Spending Accounts Human Resources University Of Michigan

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Irs Announces 2022 Health Savings Account Hsa Limits Ameriflex

2020 Fsa Contribution Cap Rises To 2 750

The Small Business Guide To Fsas For 2020 Workest

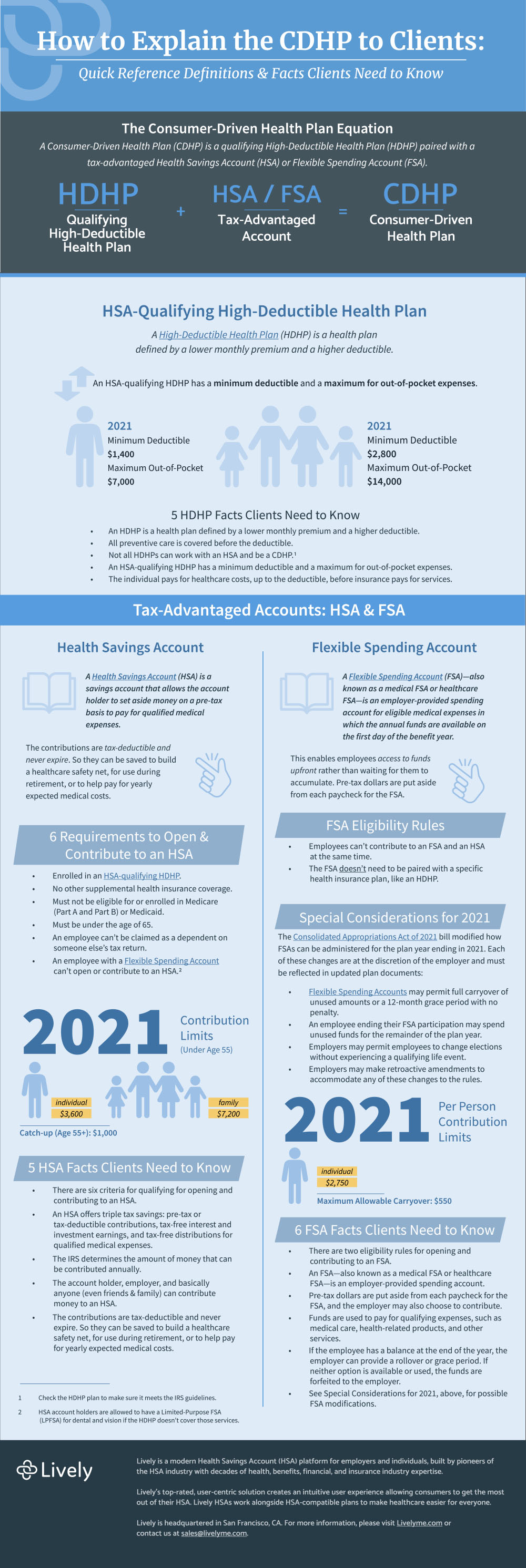

Infographic How To Explain The Cdhp To Clients Lively

Irs Announces Health Fsa Limits For 2021 M3 Insurance

Health Care Fsa Limit Projected To Remain The Same For 2021 Employee Benefits Corporation Third Party Benefits Administrator

Consolidated Appropriations Act Of 2021 Flexible Spending Account Provisions Tri Ad

Irs Announces 401 K Fsa Contribution Limits For 2021 Hr Executive

Updated 2021 Limits For Fsa And Commuter Benefits Sequoia

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Irs Issues Guidance On Consolidated Appropriations Act Fsa Forfeiture Relief Lexology

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Hsa Dcap Changes For 2022 Blog Medcom Benefits

Stimulus Act Raises Dependent Care Fsa Limits Adjusts Tax Credit